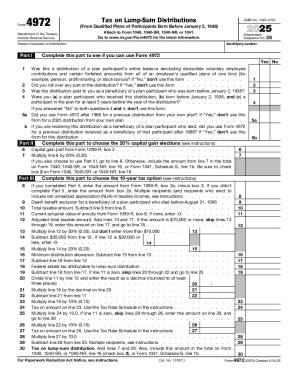

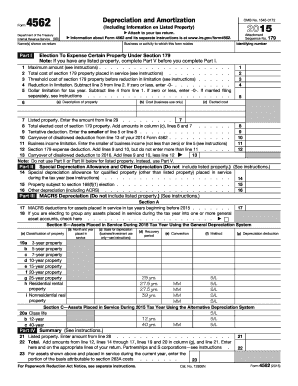

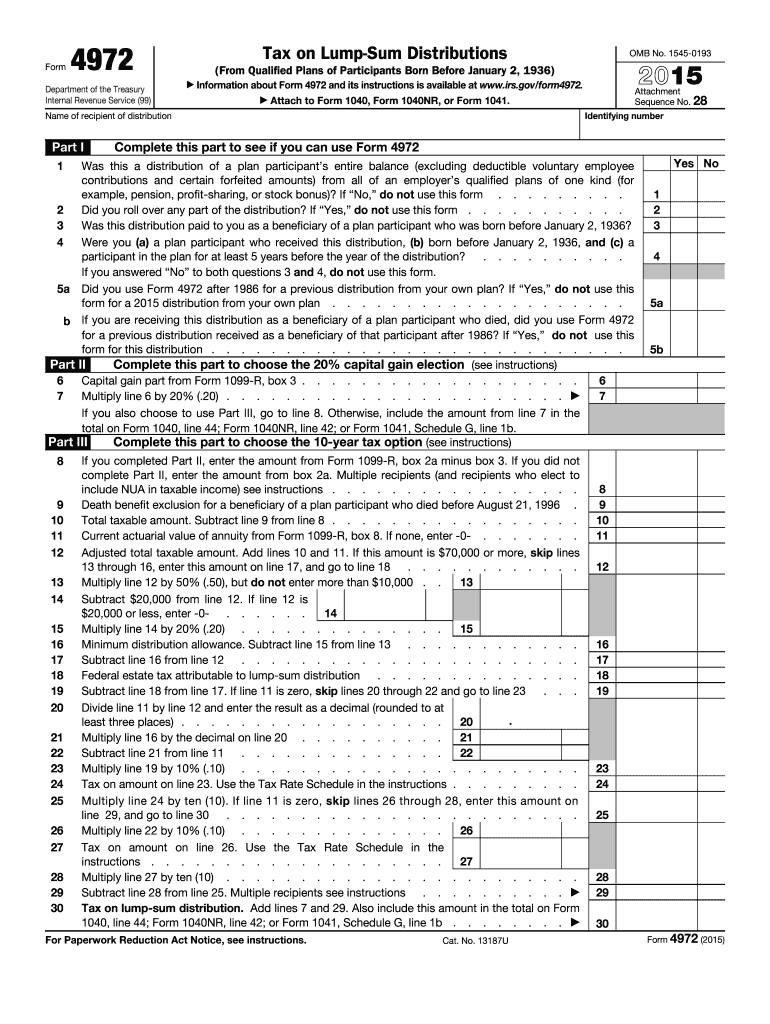

IRS 4972 2015 free printable template

Instructions and Help about IRS 4972

How to edit IRS 4972

How to fill out IRS 4972

About IRS 4 previous version

What is IRS 4972?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4972

What should I do if I need to correct a mistake on my filed 2015 form 4972?

If you discover an error after filing your 2015 form 4972, you will need to submit an amended return using the appropriate process. You can correct mistakes by filing a Form 1040X, Amended U.S. Individual Income Tax Return, where you can explain the changes and update your information accordingly. Ensure to follow up with the IRS to verify that your amended form has been processed.

How can I verify that the IRS received my 2015 form 4972?

To verify receipt of your 2015 form 4972, you can use the IRS 'Where's My Refund?' tool if you're expecting a refund, or call the IRS directly to inquire about your submission. Having your personal information and filing details ready will help expedite the process. Keep your confirmation or tracking number handy if you filed electronically.

What should I do if my e-filed 2015 form 4972 gets rejected?

If your e-filed 2015 form 4972 is rejected, the IRS will provide an error code and a brief explanation. Carefully review the reason for rejection, correct the issues outlined, and resubmit the form. If you encounter repeated rejections, consider reaching out to a tax professional or reviewing IRS resources for common rejection codes related to this form.

What are the record retention requirements for the 2015 form 4972?

It is essential to retain records associated with your 2015 form 4972 for at least three years from the date you filed your return or the due date of the return, whichever is later. This retention period helps assure that you have necessary documentation in case of an audit or if you need to reference details in the future.

Are there any common errors to avoid when filing my 2015 form 4972?

Yes, common errors include incorrect names or Social Security numbers, miscalculations in tax amounts, and failing to sign the form. It’s imperative to double-check all personal and financial details for accuracy before submission to prevent delays and potential notices from the IRS regarding your 2015 form 4972.

See what our users say